Financial Success Through Legacy Planning

Our family office is here to help navigate your financial future and reach your destination. SCHEDULE A CALL“I know that there is nothing better for people than to be happy and to do good while they live. That each of them may eat and drink, and find satisfaction in all their toil—this is the gift of God.” Ecclesiastes 3:12-13

“I know that there is nothing better for people than to be happy and to do good while they live. That each of them may eat and drink, and find satisfaction in all their toil—this is the gift of God.” Ecclesiastes 3:12-13

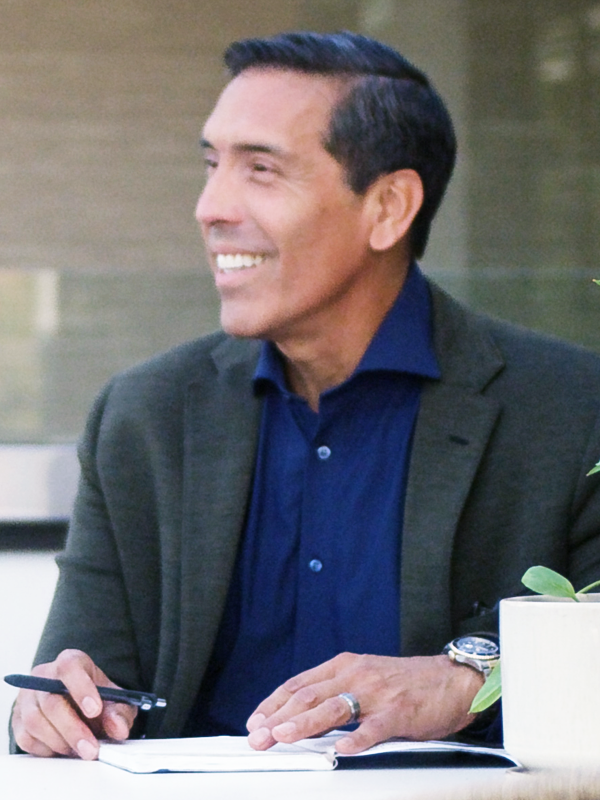

Meet Martin Lombrano, Your Primary Advisor

With more than 30 years guiding people toward their financial goals, Martin holds his clients personal and financial well-being above all else.

A stress-free retirement. Ample time to enjoy life and pursue passions. No worries about finances. That’s what we all want.

The reality is that achieving a financially secure retirement isn’t an accident. It requires years of thoughtful planning, strategic investment management, and sound advice. This is where Primary Advisors comes in.

As a trusted fiduciary, we prioritize your needs above everything else. Our commitment to your financial success goes beyond just managing your assets; it’s about building a roadmap towards your ideal retirement, helping you navigate the intricacies of financial planning, and offering expert advice that respects your values and your vision.

High Tax. Zero Time. Big Revenue Goals.

3 Critical Answers For Entrepreneurs Ready to Scale

Quarterly taxes for your $1M+ business too high? Read this FREE guide and find out:

- 4 specific questions to reveal if your revenue has outgrown your tax strategy

- How to run a simple (and quick) capacity “test”

- When to worry about expenses vs. when to focus on generating more revenue

High Tax. Zero Time. Big Revenue Goals.

3 Critical Answers For Entrepreneurs Ready to Scale

Quarterly taxes for your $1M+ business too high? Read this FREE guide and find out:

- 4 specific questions to reveal if your revenue has outgrown your tax strategy

- How to run a simple (and quick) capacity “test”

- When to worry about expenses vs. when to focus on generating more revenue

“From chaos to organization…”

Our clients are with us for a reason. Many reasons, actually. Here are just a few…

You deserve peace of mind when it comes to your retirement plans. But let’s face it, managing investments and planning for retirement can be complex.

You might find yourself asking:

-

-

- “Am I saving enough for retirement?”

- “How can I ensure a steady income post-retirement?”

- “Are my investments aligned with my long-term financial goals?”

- “How do I optimize my asset allocation for my age and risk tolerance?”

-

Wealth Advisor vs. Financial Advisor-What’s the Difference?

Until relatively recently, the term “financial advisor” was used to describe various positions across the financial industry. Recent regulation from the U.S. Securities and Exchange Commission (SEC), called Regulation Best Interest (Reg BI), has limited who can use the title. Any advisor registered with the SEC is legally required to abide by fiduciary duty, and as a result, must put clients’ interests ahead of their own.

A wealth manager, who is also a fiduciary, is legally required to do the same.

Martin Lombrano, Fiduciary Wealth Advisor

A wealth manager is a subset of a financial advisor that primarily offers high-net-worth and ultra-high-net-worth clients wealth management services. But a wealth manager’s role is far more comprehensive than just offering investment advice. They focus on a suite of services that encompasses all parts of a person’s financial life. This can include investment management and holistic financial planning, as well as accounting and tax services, retirement planning and estate planning.

You don’t need to navigate these questions alone.

Our experienced team at Primary Advisors is here to provide clear, concise, and comprehensive solutions for your financial quandaries. Our approach involves understanding your unique needs and aspirations, followed by crafting a personalized investment strategy that works for you.

Your Journey Starts Here

Step 1: UNDERSTAND

We learn about your goals, needs, and dreams for retirement.

Step 2: PLAN

We create a tailored retirement and investment strategy that aligns with your aspirations.

Step 3: IMPLEMENT

We put your personalized plan into action, regularly monitoring and adjusting to ensure it stays on track.

Step 4: SUSTAIN

We maintain an ongoing relationship with you, refining your strategy as needed to adapt to your life changes and market shifts.

Imagine waking up every morning, knowing that your financial future is in secure hands.

That’s the peace of mind we strive to deliver at Primary Advisors. As your partner in this journey, we don’t just guide you through the financial labyrinth. We equip you with the knowledge you need to make informed decisions about your wealth.

Your dreams and ambitions are not just another job to us. They are a responsibility we carry with utmost dedication.

When you choose Primary Advisors, you’re not just picking a company; you’re selecting a committed partner who will stand by you, with a shared focus on your financial success and a secure retirement.

Ready to take control of your financial future? Let’s talk.

Start your journey towards a worry-free retirement today. Contact Primary Advisors for a complimentary consultation and let us help you make your retirement dreams a reality.